IDO Ended 23 сент. 2025 — 25 сент. 2025

Raising $ 300.00K

Tokens For Sale:10,000,000

Platform:Spores Network

Lock-up:TGE 15.00%, 1m Cliff, 3m Linear Month...

IDO Ended 23 сент. 2025 — 24 сент. 2025

Raising $ 300.00K

Tokens For Sale:10,000,000

Platform:BSCS

Lock-up:15% at TGE, 1-month cliff, 4-month li...

IDO Ended 23 сент. 2025 — 24 сент. 2025

Raising $ 250.00K

Tokens For Sale:8,333,333

Platform:KingdomStarter

Lock-up:15% at TGE, 1 month cliff, 3 months v...

What is Lendr.fi?

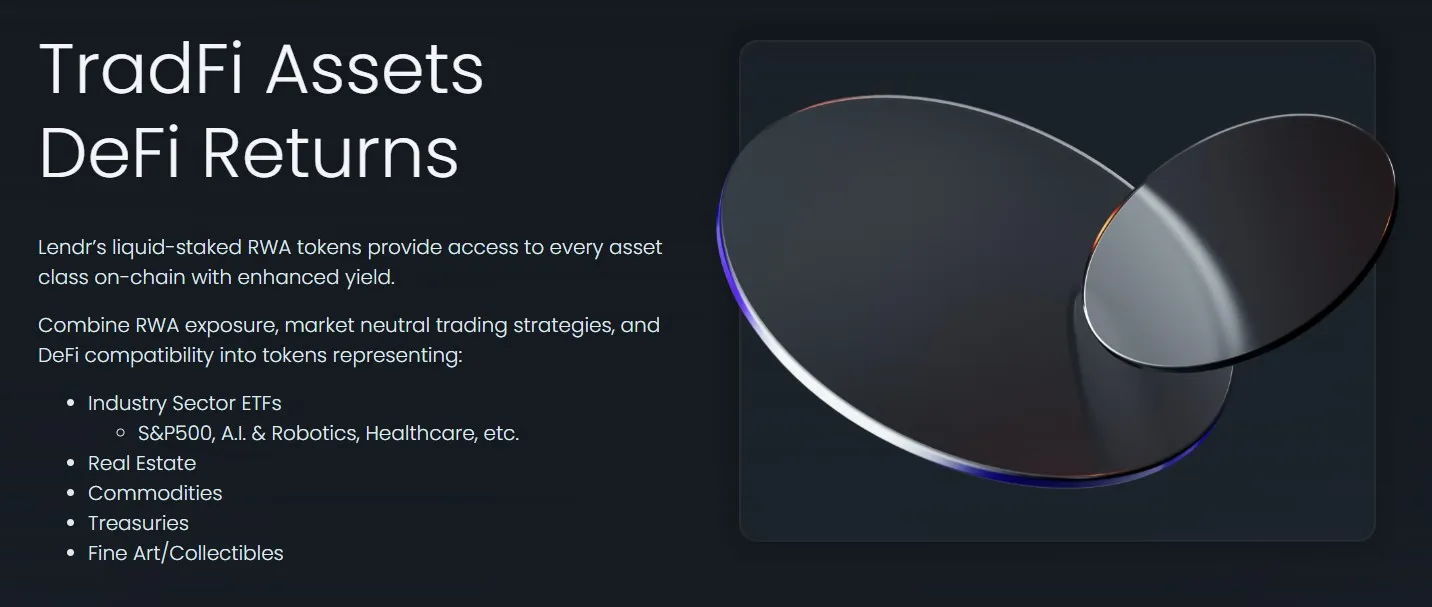

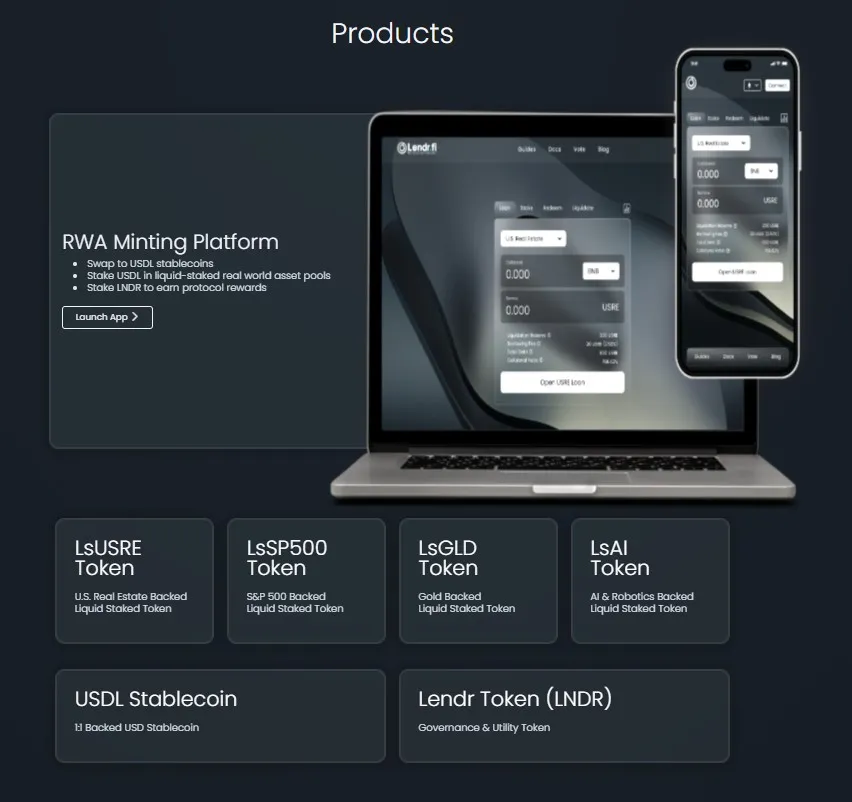

Lendr is a decentralized protocol that creates real-world asset (RWA) synthetic tokens representing various asset classes, such as US real estate, energy, and electric vehicles. The platform offers an inflation-protected stablecoin (USDL) and a decentralized lending platform for generating these RWA tokens. The platform features a staking system for rewards and stability, ensuring overcollateralization and liquidity of tokens. Lendr operates on immutable public smart contracts, with a focus on security and decentralization.

Key Features

- Real-World Asset Tokenization: Lendr.fi converts various physical and traditional assets into digital tokens on the blockchain.

- Liquid Staking: The tokenized assets function as liquid staking tokens, making them usable within existing DeFi protocols.

- DeFi Integration: These RWA-backed tokens can be used for lending, yield farming, and other DeFi activities.

- Enhanced Yield: The protocol incorporates market-neutral trading strategies to provide additional returns on the tokenized assets.

- Global Access: It offers users worldwide 24/7 access to a broader range of familiar investments, bridging the gap between traditional and decentralized finance.

- Decentralization: The platform operates on a fully decentralized, permissionless system.

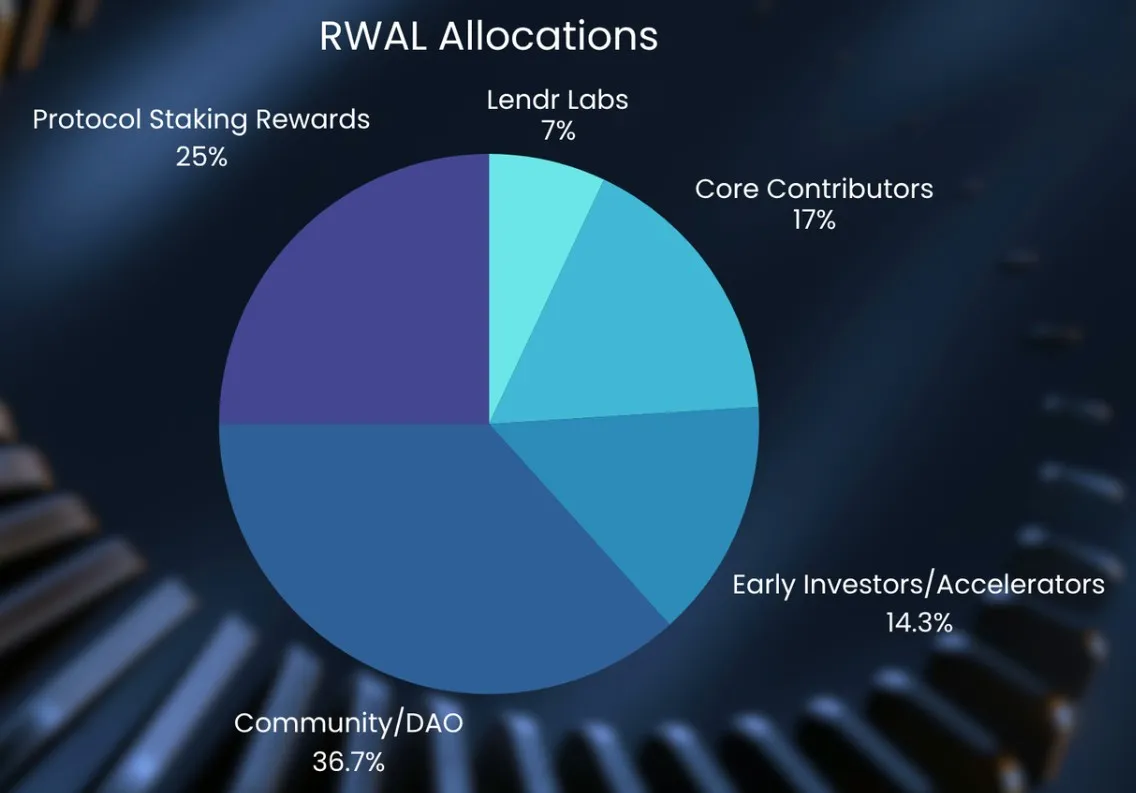

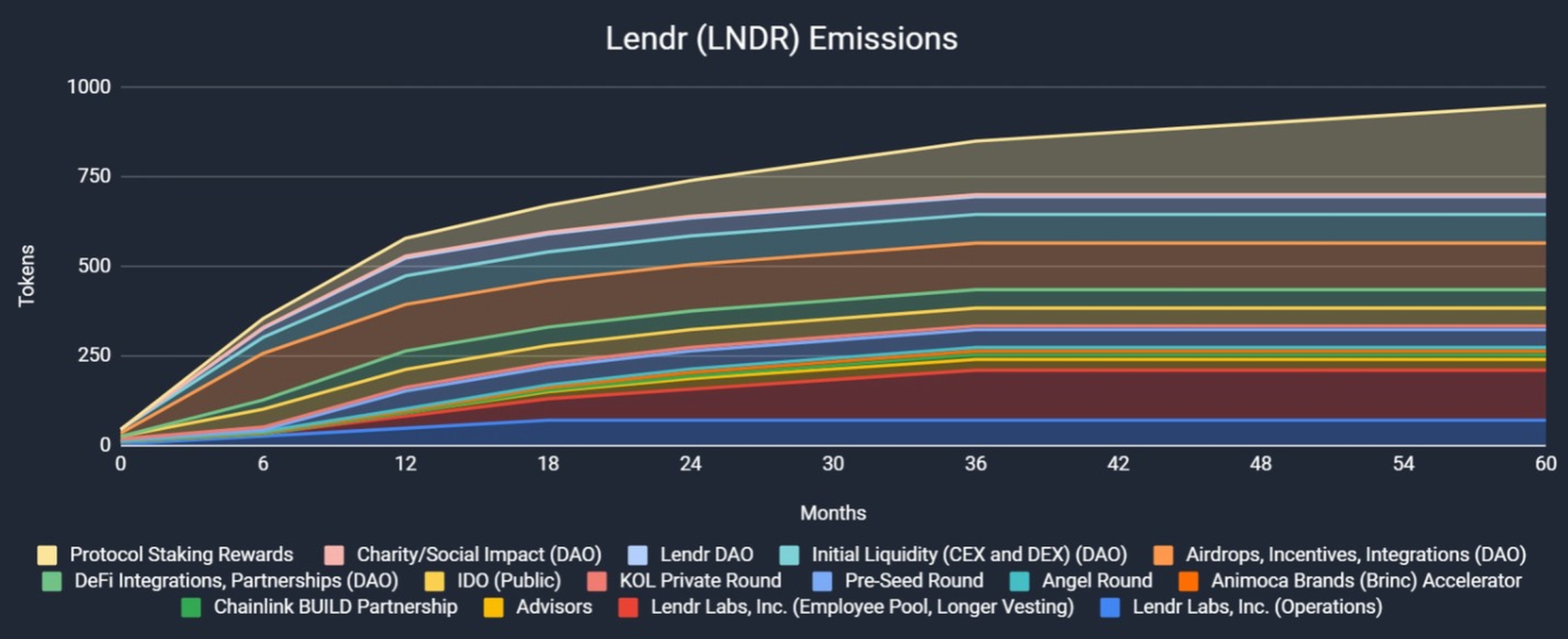

LNDR Emissions

Additional data