Bitcoin Falls Below $109,000: Liquidations Exceed $970 Million, Fear Index Enters ‘Red Zone’

On the evening of September 25, 2025, the price of Bitcoin fell below the $109,000 mark, triggering a sharp decline in the entire crypto market. By the time of publication, BTC had managed to partially recover and was trading slightly above this level, but volatility remains high.

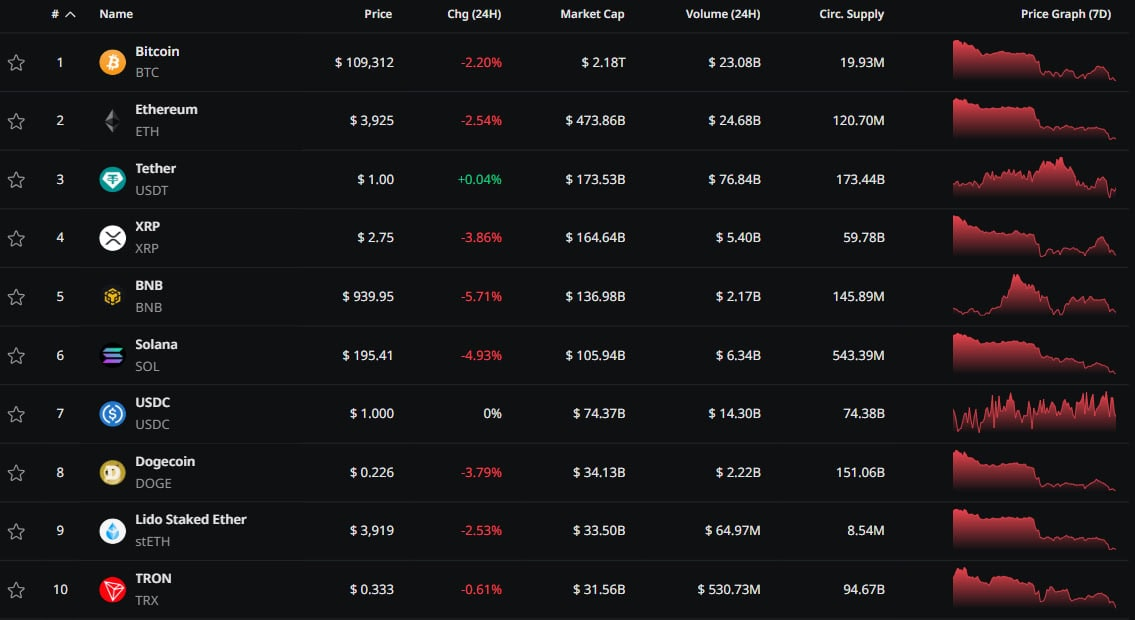

All assets in the top 10 by market capitalization also went negative. The largest drop was recorded for BNB, which lost 5.71% in a day.

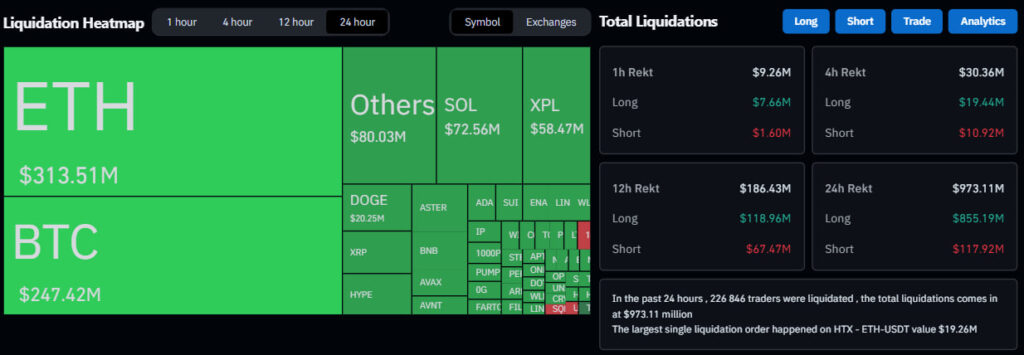

The collapse in quotes caused mass liquidations in the cryptocurrency derivatives market. According to CoinGlass, positions of nearly 227,000 traders were closed in a day for a total of over $970 million. Of these, about $855 million were long positions and $118 million were shorts. The largest volumes of liquidations were recorded in Bitcoin ($247 million) and Ethereum ($313 million).

The Fear and Greed Index dropped by 7 points, reaching a level of 32 — this corresponds to the fear zone, signaling an increase in negative sentiment among market participants.

Crypto researcher Ash Crypto highlighted several reasons for the collapse:

- Expiration of options worth $23 billion on Bitcoin and Ethereum.

- Risk of a US government shutdown — the probability is estimated at 67% by October 1, which traditionally heightens panic sentiment in the markets.

- Macroeconomic factor — US GDP in the second quarter grew by 3.8% against expectations of 3.3%, which increased expectations of policy tightening and temporarily strengthened the ‘bearish’ trend.

- Mass liquidations — positions opened by traders with high leverage on DEX triggered a chain reaction of closures.

The market remains under pressure, and the further dynamics of BTC will depend on the reaction of institutional investors and news from the US.