The First Spot Dogecoin ETF in the US to Begin Trading on September 11

On September 11, 2025, trading will begin for the first spot exchange-traded fund in the US based on Dogecoin (DOGE). The new product, developed by REX Shares and Osprey Funds, will have the ticker DOJE and will function as a mutual fund. Asset management will be handled by the REX-Osprey DOGE (Cayman) Portfolio S.P. structure.

The fund is registered under the Company Act of 1940, which allows it to bypass the lengthy approval process with the US Securities and Exchange Commission (SEC). This format makes the product similar to traditional ETFs on stocks and bonds, providing stricter investor protection requirements.

According to Further Ventures specialist Ganesh Mahidhara, registration under the ’40 Act’ creates obligations for the issuer to use an investment structure with increased oversight.

Previously, REX Shares and Osprey Funds used a similar approach when launching the Solana ETF and also filed an application for a BNB ETF. Despite the SEC’s skepticism, the first product hit the market, and now it’s Dogecoin’s turn.

Bloomberg Intelligence analyst Eric Balchunas emphasized that the launch of DOJE could symbolize a new era:

“It seems the era of meme coin ETFs is beginning. This is almost certainly the first fund in US history to hold an asset that was originally created without utility.”

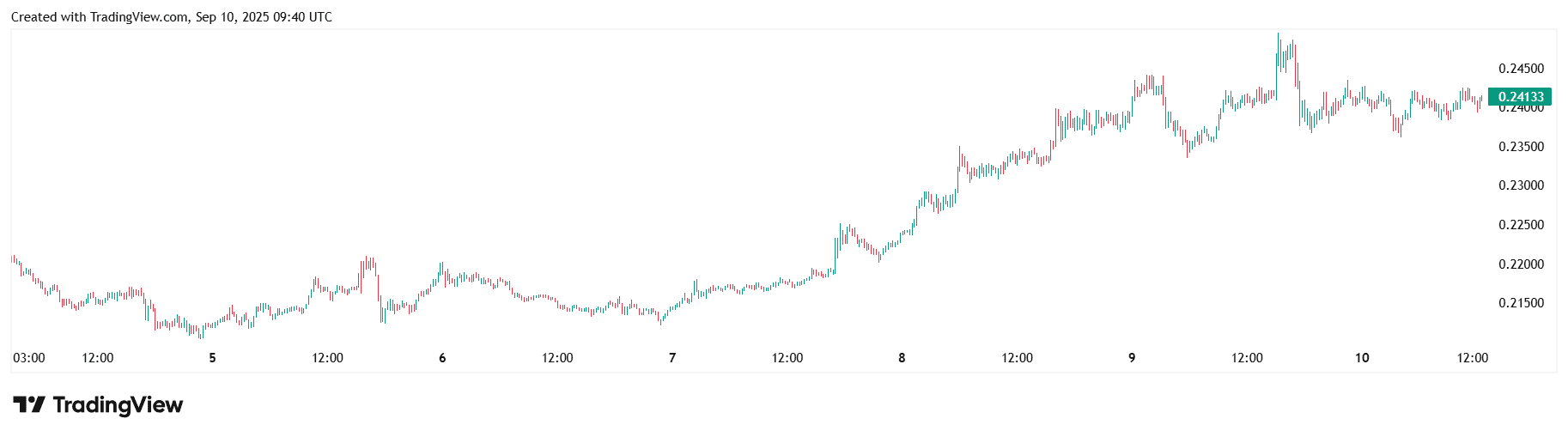

Amid the news, Dogecoin rose by 12.2% over the week, strengthening to local highs.

The reaction was commented on by DogeOS CEO Jordan Jefferson:

“Dogecoin started as a joke, and now Wall Street finally gets it. The approval of the ETF proves that institutional investors see value in the community and culture. When pension funds buy an asset that originated as a joke, it’s a unique moment in financial history.”

Meanwhile, other ETF issuers registered under the Securities Act of 1933 are still awaiting an official SEC decision.