Aster Exchange Leads Derivatives Market, Doubling Hyperliquid Volume

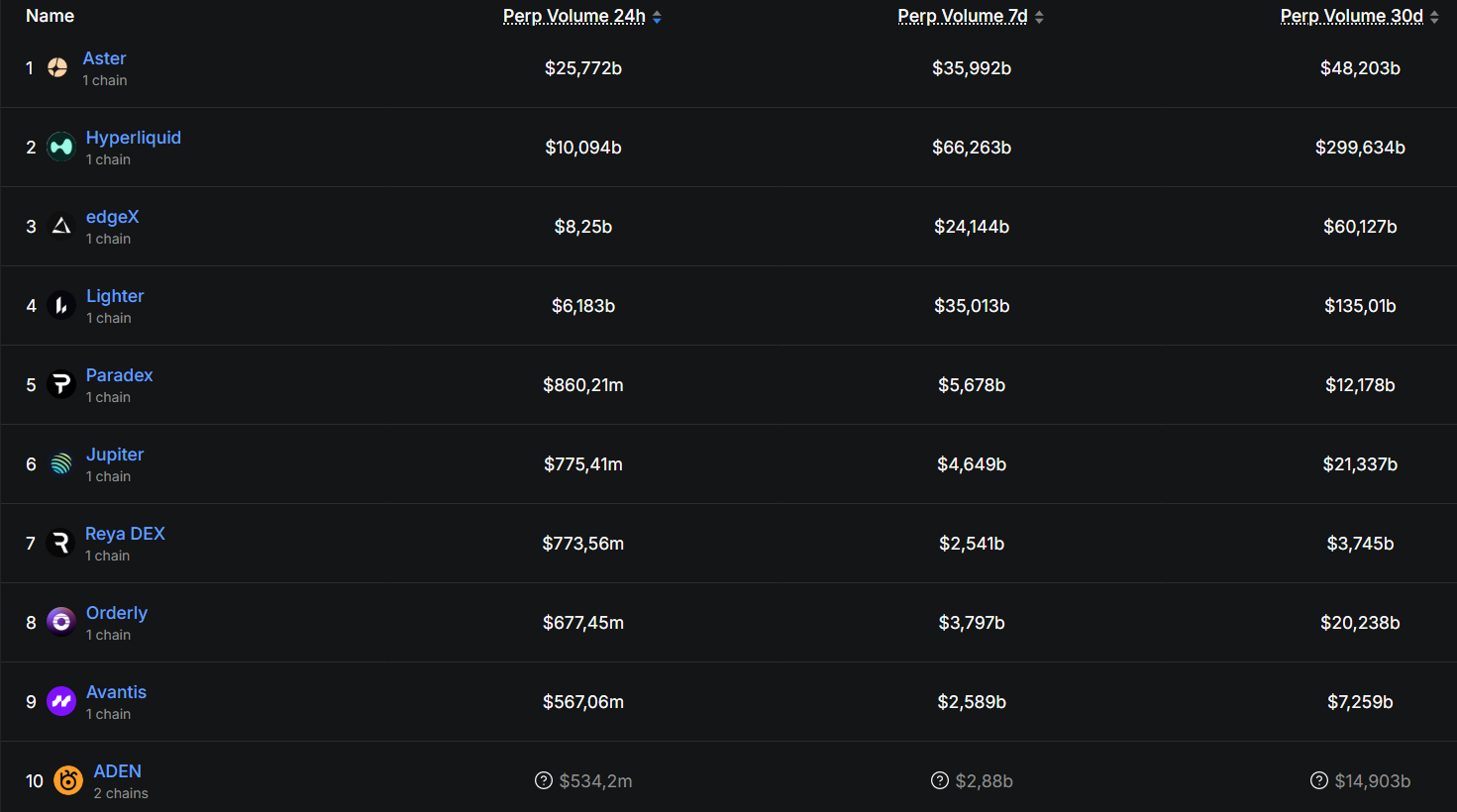

The decentralized derivatives sector has a new leader. The Aster platform reported a daily trading volume of perpetual contracts at $25.77 billion, more than double Hyperliquid’s $10.09 billion, notes DeFiLlama.

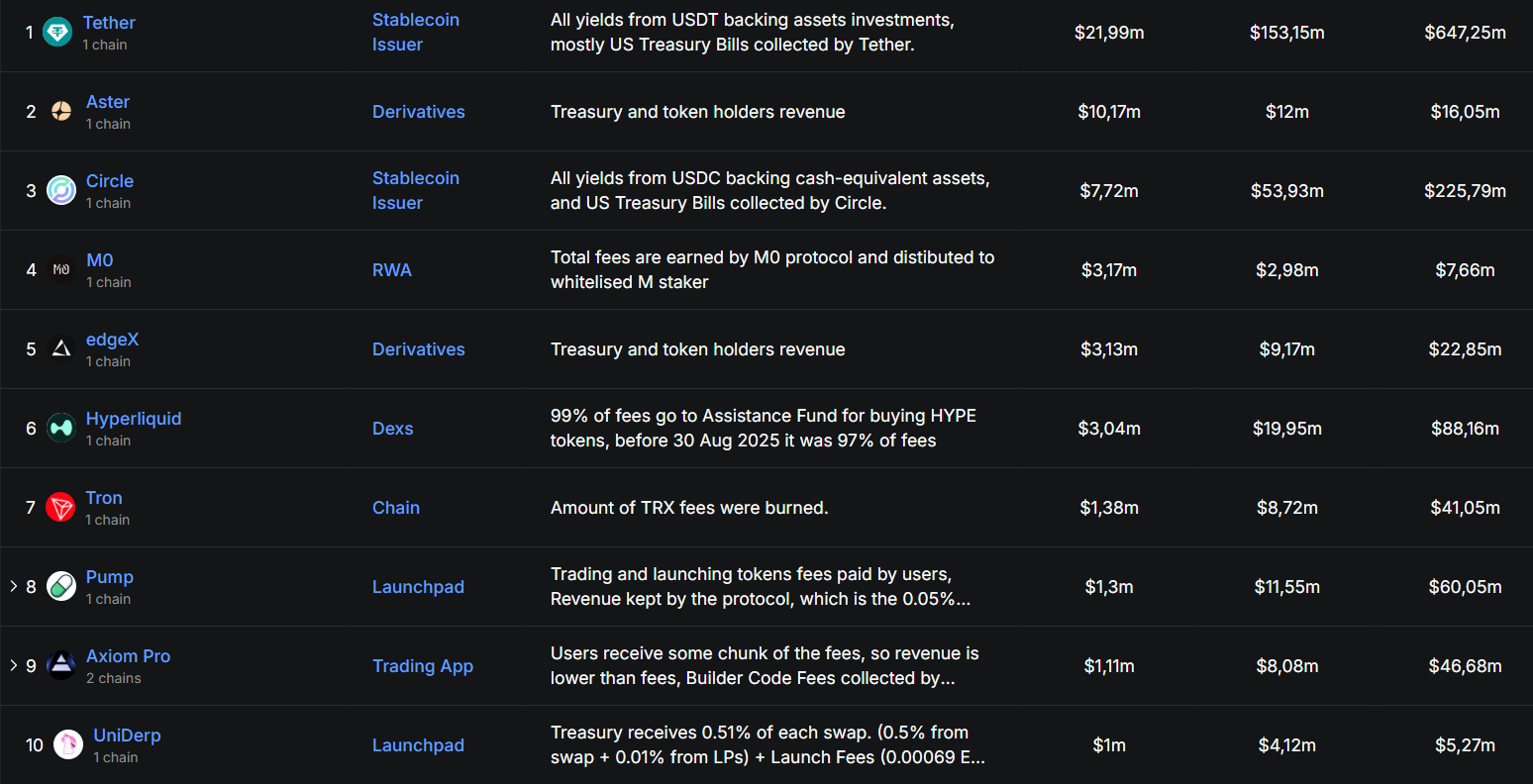

The success is also reflected in another ranking: the exchange collected $10.17 million in fees in one day, ranking second among all DeFi protocols. Hyperliquid was in sixth place in this table.

Aster emerged after the merger of Astherus and APX Finance projects. In September, the team conducted the generation of ASTER tokens and launched loyalty points farming. The second phase of the Genesis Stage 2 campaign will last until October 5, with a portion of 53.5% of the tokens allocated for the airdrop.

The sudden interest in the platform is explained by several factors: a large-scale token distribution, as well as support from YZi Labs and former Binance head Changpeng Zhao. Investor interest in Astherus appeared back in 2024 when YZi Labs invested in the project and possibly included it in its incubator.